The recent developments in digital technologies (e-commerce, social media and networks, mobile computing, sensor technologies) have not only driven individuals to leave an increasingly long digital trace behind them, but have also made available the tools to assemble, harness and analyse large and complex datasets (so-called ‘Big data’). As a consequence, sellers now have expanded capabilities to track the behavior of their consumers and, thereby, to gain a better knowledge of them (in terms of tastes, habits, willingness to pay, etc). As an illustration, this Guardian article published in July 2014 lists a number of tools that sellers can use to track their consumers both online and offline.

Through online tracking mechanisms such as supercookies, browser fingerprinting, location-based identifiers, behavioural tracking, and social network leakage, marketers track both real-time behaviours on web sites – down to what you type, mouse over, purchase – and detailed personal data. So when you land on an e-commerce site, without telling the retailer anything about yourself, they know your age, gender, physical location, favourite websites, favourite movies, comments you’ve left across the web, estimates of your income, marital status, whether you own a home, etc.

This sophisticated tracking has also arrived in brick-and-mortar stores. In-store cellular and wi-fi signal tracking systems can monitor consumers as them move through malls and stores. Apple’s iBeacon technology is now being used to track consumers to within several feet of a location within a store and even at concerts. Video surveillance and eye tracking systems track what consumers look at, focus on, and are “engaged” by. One of the most far-reaching of these initiatives involves Facebook’s partnership with data firms Acxiom, Datalogix and Epsilon to connect in-store purchases from retailer loyalty card data to Facebook user profile data.

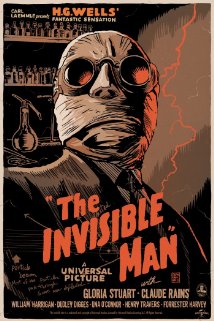

Yet, the same technological developments have also enabled individuals to protect their privacy (e.g., by erasing their digital trace or by concealing their actions online). For instance, this article published by L’Usine Digitale in August 2015 describes several technologies that may allow you to live incognito in the digital age. First, you may want to use search engines like DuckDuckGo or Qwant that commit to respect your privacy by avoiding to track you. Second, if you don’t trust public cloud services (e.g., Dropbox or Google Drive) to store your personal data, you may install a personal cloud service (e.g., Cozy Cloud), which you can customize and fully control. Third, if you want to protect your emails from external intrusions, why not installing an email server, like Own-Mailbox, with strong privacy protection measures (e.g., automatic encryption) integrated at its core? Finally, if you are very

Yet, the same technological developments have also enabled individuals to protect their privacy (e.g., by erasing their digital trace or by concealing their actions online). For instance, this article published by L’Usine Digitale in August 2015 describes several technologies that may allow you to live incognito in the digital age. First, you may want to use search engines like DuckDuckGo or Qwant that commit to respect your privacy by avoiding to track you. Second, if you don’t trust public cloud services (e.g., Dropbox or Google Drive) to store your personal data, you may install a personal cloud service (e.g., Cozy Cloud), which you can customize and fully control. Third, if you want to protect your emails from external intrusions, why not installing an email server, like Own-Mailbox, with strong privacy protection measures (e.g., automatic encryption) integrated at its core? Finally, if you are very paranoid farsighted, you may already want to prevent drones from spying above your house; the ‘drone catcher’ developed by Malou Tech may then come in handy. Or better, you may get in line to be among the first users of Harry Potter-like invisibility cloaks that researchers from UC Berkeley or the University of Rochester are currently developing.

Digital technologies are thus exacerbating a cat-and-mouse game between sellers and consumers: on one side, sellers (the big cats) use tracking and data analysis technologies to target advertising, product offerings and prices to their customers with an unprecedented precision; on the other side, consumers (the small mice) may want to use some hiding technologies to protect themselves against what could be perceived as an invasion of their privacy. (To see how economists try to estimate the value that individuals attach to their privacy, see the article by Eva-Maria Scholz on this blog).

Digital technologies are thus exacerbating a cat-and-mouse game between sellers and consumers: on one side, sellers (the big cats) use tracking and data analysis technologies to target advertising, product offerings and prices to their customers with an unprecedented precision; on the other side, consumers (the small mice) may want to use some hiding technologies to protect themselves against what could be perceived as an invasion of their privacy. (To see how economists try to estimate the value that individuals attach to their privacy, see the article by Eva-Maria Scholz on this blog).

Because both sides are now equipped with more sophisticated weaponry, it is not clear to determine who wins and who looses in this game.

We have already argued on this blog (here and here) that targeted advertising may lead to a win-win situation; in particular, consumers may benefit from more targeting when it intensifies competition among firms.

Consider now the use of big data and tracking technologies to target prices. This practice is known as price discrimination in economics. In its extreme form, called ‘personalized prices’, the seller charges a different price to each consumer. (Mikians et al. (2012) empirically demonstrate the existence of signs of such price discrimination on the Internet. This article published by The Conversation in April 2014 gives some examples.) Clearly, if the seller acquires a better knowledge of its consumers (and can prevent resale among consumers), it will be in a position to charge prices that come closer to the maximum price that each consumer would accept to pay.

The intuition suggests thus that in the case of price targeting, the cat is likely to prevail over the mice. This is especially true if the cat faces no competition. In particular, the theory shows that a monopolist that can price discriminate more easily will increase its profits at the expense of the well-being of the consumers.

One would therefore expect that if the mice can benefit from extra protection, i.e., if consumers can resort to hiding technologies as the ones described above, their situation would improve. In economic terms, better hiding technologies should allow consumers to recover (at least partially) the consumer surplus that the seller was able to capture by using better tracking technologies.

As my recent research shows, this intuition is not correct: adding insult to injury, the use of privacy-protecting technologies may decrease the well-being of consumers even further.

As my recent research shows, this intuition is not correct: adding insult to injury, the use of privacy-protecting technologies may decrease the well-being of consumers even further.

I establish this point in a monopoly setting where the firm has access to a tracking technology that allows it to identify the willingness to pay of its consumers with some probability; the firm then charges personalized prices to the consumers it identifies and a common regular price to the consumers it does not identify. Consumers have the possibility to acquire a hiding technology that makes the firm’s tracking technology inoperative.

The main result is that the consumer surplus is often larger when this hiding technology is not available. In fact, when the technology is available, the firm has two reasons to raise the regular price of its product. First, a higher regular price discourages hiding. Second, the very fact that some consumers decide to use the hiding technology allows the monopolist to identify them as consumers with a high willingness to pay for the product, who can thus be charged a higher price (consumers with a high willingness to pay are indeed those who can gain the most by hiding).

As a result, what some consumers gain by protecting their privacy is often more than offset by what the other consumers lose by paying a higher price. That is, consumers may end up collectively worse off when hiding technologies are available.

It is important to note that these results are likely to change if the seller faces competition from other sellers. This research is currently in progress. So, stay tuned!

(Photo credits: Josh Hallett – Tracey Mahler – Lisa Omarali)